Medical Debt Overwhelming You? How Bankruptcy Can Offer Relief

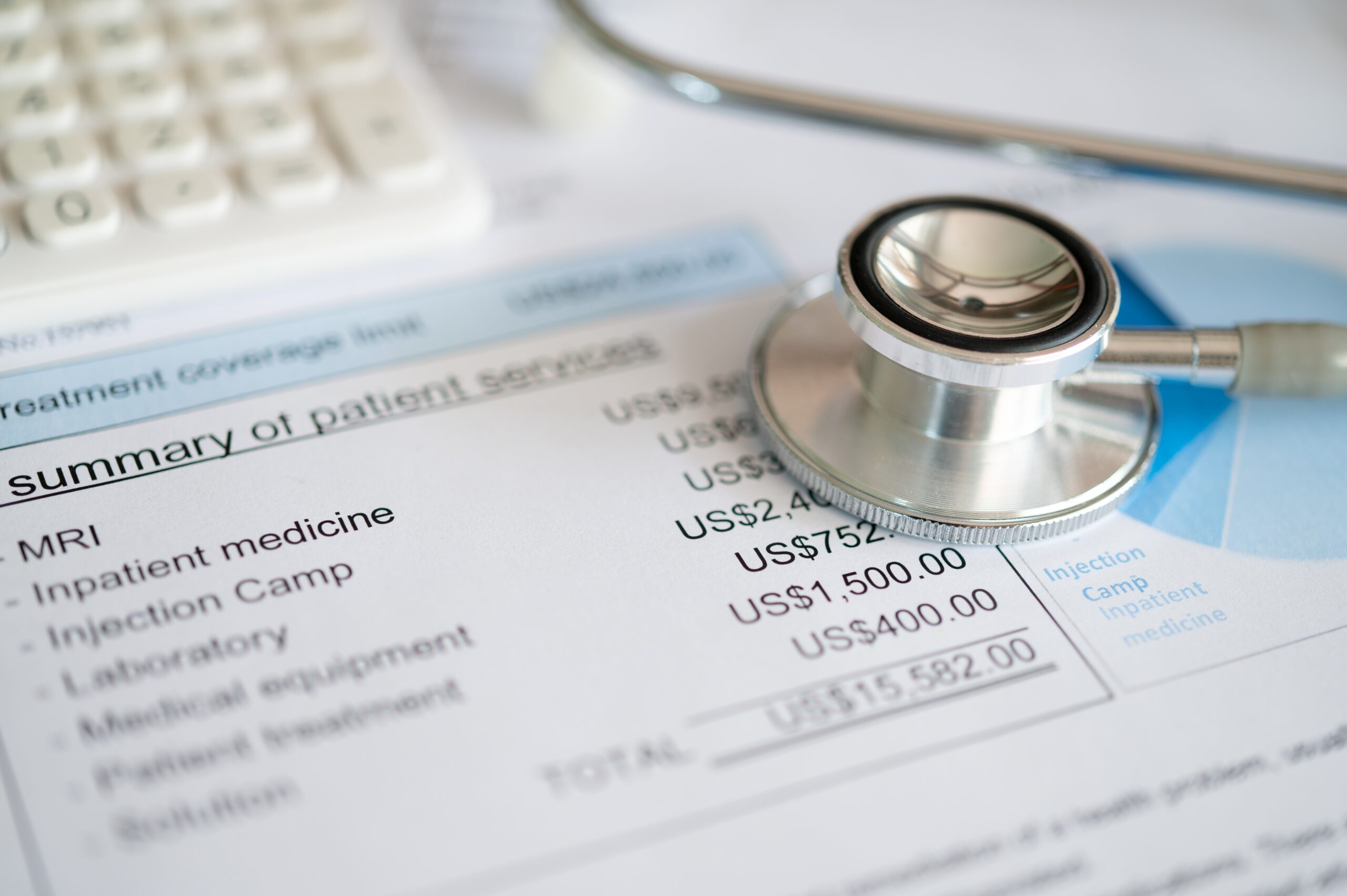

For many Americans, a sudden illness or injury brings more than just physical pain — it brings a financial crisis. Even with insurance, deductibles, copays, and out-of-network charges can accumulate rapidly, leaving families forced to choose between paying for groceries or paying the hospital.

At the Law Office of Michael Schwartz, we understand that falling behind on medical bills is rarely a result of poor spending habits. It is often an unavoidable consequence of a broken healthcare system. When the calls from collection agencies start coming in, it can feel like there is no way out. However, legal avenues exist to help you regain your financial footing.

If you are a resident of Southampton, Havertown, Perkasie, or Bucks County, PA, understanding how medical debt functions within the legal system is the first step toward relief. While the term “medical bankruptcy” isn’t a separate legal category, using bankruptcy specifically to resolve healthcare costs is a common and effective strategy. Our attorneys will explore your options, from negotiation to filing for Chapter 7 or Chapter 13 bankruptcy.

Understanding Medical Debt

Medical debt is distinct from other types of consumer debt, such as credit cards or personal loans, because it is almost always involuntary. No one plans to have a medical emergency. Despite this, it is treated as “unsecured debt” in the eyes of the law, placing it in the same category as credit card balances and utility bills.

Because this debt is unsecured — meaning there is no collateral like a house or car attached to it — it is often the most dischargeable type of debt in bankruptcy proceedings. Before you take that step, however, it is vital to ensure you have exhausted other avenues.

Options Before Filing for Bankruptcy

Bankruptcy is a powerful tool, but it has long-term credit implications. Before filing, you should investigate whether the debt can be reduced or managed through other means.

Hospital Financial Aid Programs

Nonprofit hospitals are required by law to have financial assistance policies. Even some for-profit institutions offer charity care. You may qualify for debt forgiveness or a significant reduction in your bill based on your income level.

Contact the hospital’s billing department immediately and ask for an application for financial assistance or “charity care.” Do not assume you earn too much to qualify until you have checked their specific guidelines.

Auditing Your Medical Bills

Medical billing errors are incredibly common. You have the right to request an itemized bill that includes Current Procedural Terminology (CPT) codes. Review this document carefully. Look for:

- Duplicate charges: Being billed twice for the same medication or procedure.

- Unreceived services: Charges for tests or supplies that were never administered.

- Upcoding: Being billed for a more expensive version of the treatment than what you received.

If you find errors, dispute them in writing with the billing department and your insurance company.

Negotiating with Providers

If the bill is accurate but unaffordable, try negotiating. Providers often prefer receiving a partial payment rather than selling the debt to a collection agency for pennies on the dollar. You can ask for a lump-sum discount (offering to pay a lower amount immediately to settle the account) or set up an interest-free payment plan that fits your monthly budget.

Nonprofit Credit Counseling

A certified nonprofit credit counselor can help if you are struggling to negotiate on your own,. They may be able to place you on a Debt Management Plan (DMP). In a DMP, you make one monthly payment to the counseling agency, which then distributes the funds to your creditors. Counselors can also offer an objective opinion on whether a medical bankruptcy is your best option.

Medical Debt and Bankruptcy

If the options above fail to solve the problem, or if the debt is simply too large to ever be repaid, bankruptcy may be the solution. Since medical bills are unsecured debt, they are generally low priority in bankruptcy proceedings, meaning they can often be wiped out entirely.

Chapter 7 Bankruptcy: The “Fresh Start”

Chapter 7 bankruptcy, often called “liquidation,” is designed for individuals who cannot afford to pay back their debts.

- How it works: A court-appointed trustee reviews your assets. While the term “liquidation” suggests selling everything, Pennsylvania offers Federal and State Exemptions that allow you to typically keep many assets like your car, clothing, household goods, and retirement accounts. Non-exempt assets are sold to pay creditors, and the remaining unsecured debt — including medical debt — is discharged (erased).

- Speed: This process is relatively fast, often taking only a few months from filing to discharge.

- Eligibility: To qualify, your income must be below a certain threshold, determined by a “means test.”

Chapter 13 Bankruptcy: Reorganization

If you have a steady income and significant assets you want to protect (like a home with equity), Chapter 13 might be the better path.

- How it works: This is essentially a consolidation plan. You propose a repayment plan to the court to pay back a portion of your debts over a 3-to-5-year period. The amount you pay is based on your disposable income and the value of your non-exempt assets.

- The Outcome: You make one monthly payment to a trustee. At the end of the repayment period, any remaining qualifying unsecured debt, including medical bills, is discharged.

- Benefit: This stops collection actions immediately and gives you breathing room to catch up on secured debts like a mortgage while managing medical debt.

Preparing for the Process

Filing for bankruptcy requires organization and transparency. If you decide to move forward, you will need to prepare extensively.

Gathering Necessary Documents

You cannot rely on memory for bankruptcy filings. You must provide concrete proof of your financial situation. Start collecting:

- Financial Statements: Pay stubs, tax returns for the last two years, and bank statements.

- Medical Documentation: All outstanding medical bills, collection notices, and Explanation of Benefits (EOB) forms from your insurance company. Medical debt is rarely listed on your credit report, so it is important to bring these bills to your attorney to make sure that they are included in your bankruptcy schedules.

- Asset and Debt Records: Titles to vehicles, deeds to real estate, and a list of all other debts (credit cards, student loans, etc.).

Credit Counseling Course

Bankruptcy law requires that you complete a credit counseling course from an approved agency within 180 days before you file your petition. This ensures you understand the consequences of bankruptcy and have explored alternatives.

Choosing the Right Chapter

Determining whether to file under Chapter 7 or Chapter 13 is a complex legal decision that depends on your specific financial landscape.

The Law Office of Michael Schwartz will help you navigate the “means test.” This calculation compares your average monthly income for the six months before filing against the median income for a household of your size in Pennsylvania. If your income is below the median, you likely qualify for Chapter 7. If it is above, the means test calculates your disposable income to see if you can afford a Chapter 13 repayment plan.

Your attorney will also help you assess your assets. If you have property that is not covered by Pennsylvania or federal exemptions, Chapter 13 may be necessary to prevent the trustee from selling that property.

Taking the First Step Toward Relief

Medical crises are traumatic enough without the lingering shadow of financial ruin. Whether through successful negotiation or filing for bankruptcy, relief is possible. By understanding your rights and the legal tools available, you can stop the collection calls and focus on what matters most: your health and your family.

Prioritize your future by seeking professional advice. The sooner you address the debt, the more options you will have available to resolve it.

Get Legal Help in Pennsylvania

You do not have to face creditors alone. If medical debt has taken over your life, you need an advocate who understands the local courts and the bankruptcy code.

If you reside in Southampton, Havertown, Perkasie, or anywhere in Bucks County, PA, contact the Law Office of Michael Schwartz today.